Should I stay or Should I go ?

Recognizing your Intrinsic Value - Are you growing or are you going?

Hi Friends,

Happy Lunar New Year to all my friends who are celebrating!

The title for this week will make sense by the end of this post 😁so make sure to read to the end.

In the past couple of weeks, publicly listed companies worldwide have been conducting earnings calls after they published their Q4 results for 2023.

This is important primarily for 2 reasons:

a) Current Results Commentary - The leadership provides commentary on the results and explains the performance from a quarter-to-quarter and year-to-year perspective with highlights of successes and challenges from internal and external factors. They provide some insights into the workings of the business, new clients added, factories that have come online, revenues of certain product categories or segments, and much more.

b) Future Guidance - This is the part that gives investors an indication of where the organization is heading. New products in the pipeline, where will factories increase capacity or come online, new investments that will add to increasing revenues, future volume growth projections, future earnings growth projections, etc.

A shareholder decides whether to add to their investment, hold, or even sell their shares depending on the confidence given by the management of these companies. In most cases, the results are indicative of performance and growth (or decline) and that leads to an increase/ decrease in shareholder value reflected through an increase/decrease in the share price of that company.

If the future potential holds good, it may continue to rise even if the current results don’t reflect it. There may be cases where a company has multiple things that are being worked on but have not yet hit the minimum capacity and therefore are not yet showing an impact on earnings, for example, Tesla - which is working on Full Self Driving, Optimus Robots, Robotaxis, etc., none of these potential technologies are reflecting in the results and therefore the market may not yet price in its future potential till they start to see some products.

Just to put things in perspective, it took Amazon more than 14 years of cumulative profits (58 quarters since it went live in 1997) to generate as much profit in the 4th quarter of 2017 but the share price kept going up during the period.

Sometimes companies have a great set of numbers due to external events and that may provide a windfall - for example, pharmaceutical companies during the pandemic. Once the event passes, and if they don’t have other things sustaining the results, then it will lead to a decline in the price of the shares.

In the US, the biggest companies by Market Capitalization are followed quite closely as their results provide indicative guidance on whether there is a growth in the earnings and potentially other similar companies might increase in value as well.

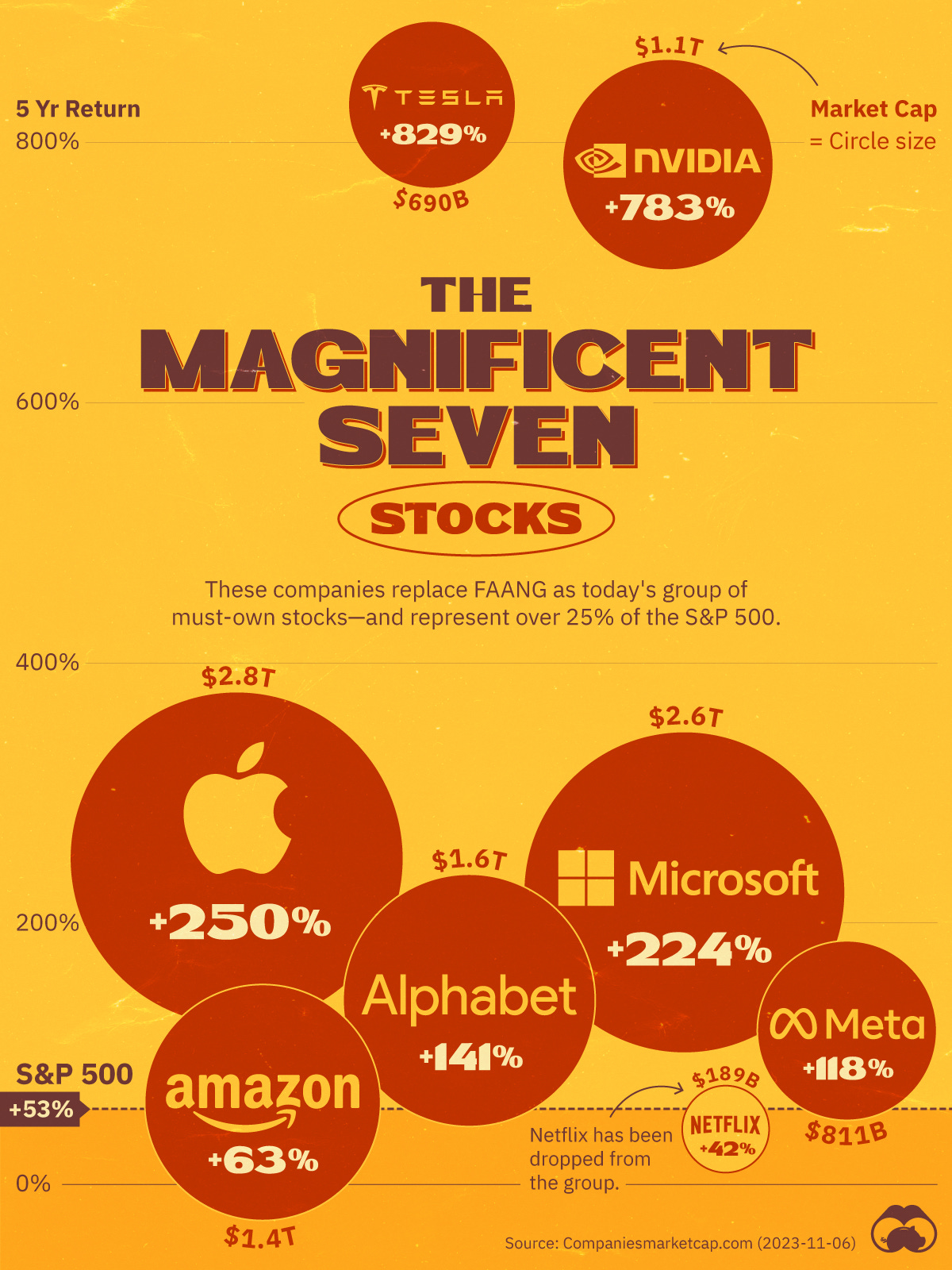

A few years ago the FAANG stocks (Facebook, Apple, Amazon, Netflix, Google) were seen as the most valuable companies in the US market.

Now it is The Magnificent Seven ( Apple, Amazon, Alphabet (Google), Meta (Facebook), Microsoft, NVIDIA, and Tesla) that are being seen as the most influential and dominant companies. These companies cut across four different sectors: Retail, Consumer Durables, Technology services, and Electronic technologies.

Microsoft just dethroned Apple as the company with the largest Market Capitalization at USD 3.124T vs $ 2.916T (Yes, that’s a T for a Trillion USD). Except for Tesla, all the other companies in the category are worth over a Trillion dollars each, which makes the combination of these companies $ 12 Trillion, and is bigger than all Chinese listed stocks according to Aswath Damodaran, who is known as the Dean of Valuation.

Now, why is all this relevant?

A company only becomes relevant if it has intrinsic value for the long term. If it is always dictated by external factors, then the moment that event normalizes or disappears, so does the profit.

I was looking into what has made Microsoft successful in the past many years. Satya Nadella - CEO of Microsoft, has increased the value of Microsoft by 10x since he took over the reins of the company exactly 10 years ago. Of course, there are many business and strategic decisions, but there was a deeper reflection more fundamental reflection.

Here are some of the learnings that he shared in an interview (mostly paraphrased but the essence is captured) :

Have a sense that you have to be grounded - When you become successful, don’t forget what made you successful. Culture, Sense of Urgency, and Focus are important. Companies can only be successful if they are able to understand the unarticulated needs of the customer.

Be Real - Making it real is a key element. Saying it and not meaning it or if you don't back it up in your walk, then it doesn’t mean much. If people in the organization start saying “What is he talking about?” and the reality is different from what’s projected - then it’s all over.

Be Humble - You have to be humble enough to recognize that nothing lasts forever and therefore you need to keep reinventing yourself.

Capabilities - Always ask yourself the question: Can you build capabilities and a conceptual understanding of what’s going to happen next long before it is conventional wisdom.

Collaboration and Partnerships - One of the largest success factors for Microsoft was that instead of viewing others as competition, they started to focus on Customer partnerships. I.e. Their customers were also their suppliers, and vice versa. The partnerships allowed them to extend their reach and collaborate with others thereby contributing to shared growth.

Macro to Micro

Taking this from an organizational level to a more micro level, what Satya describes here is not just essential for leadership, but also individuals.

(Photo by Daniel K Cheung - Unsplash)

As is the case with a company, the value of an individual can go up only if that individual continues to build intrinsic value. Building experience, new skills, collaborations, and partnerships with other similar individuals can help individuals and teams deliver value.

At the start of the post, I mentioned that companies report results and the 2 factors- Current Results and Future Guidance, are what the market is focused on.

If the company is doing great and is projecting a great future, then from an individual perspective there would be a great motivation to be part of the success story. Individuals want to be part of a successful team and are willing to go on the journey to delivering on that vision. This is the intrinsic motivation needed to pay attention to upskilling oneself and building experience in areas that will help the organization deliver on its goals.

I view my own personal development as a necessary element in contributing to the overall success of the organization. There will be periods where there is a plateau in the progress of an organization when leadership changes, or if there are organizational readjustments and generally these should only be a short-term blip on the charts.

Continuous changes lead to a situation where people and organizations are always in flux which contributes to long periods of uncertainty. This is never a good place to be and also gives a sense of being directionless. Reflecting on what Satya Nadella mentions about Being Real, if the talk by the leadership is not recognized by the teams on the ground to the point they ask the question - What are they talking about? - then there is a storm brewing.

Turn the Tables

Now flipping the conversation around and viewing the organization from an internal stakeholder perspective, how would you view the organization that you work for?

Similar to how an external shareholder assesses their investment, do you have a similar evaluation criterion for your investment of time and effort into the organization? Has there been progress in general over the years? And, do you expect future growth for yourself if the organization is also going to grow in the future?

In case the organization does not grow, and is expected not to grow in the future; will you be comfortable knowing that you may not progress? If the answer is no - then what are you going to do about it?

Side note: I would like to point out a couple of things: a) not everyone in the organization wants to grow, some people want a regular job and are happy doing the tasks they were hired to do; and b) growth does not only mean promotion or pay rises, that I only a part of it. What I mean by growth is getting opportunities to learn new skills, getting into new roles, working on projects that would help me in my career long term, and having a path to build my career to roles that I want in the future. One additional element of growth for me is that it comes through merit, and not through quotas.

(Photo by Liam Hans - Unsplash)

Coming back to the main topic: The same as how an employee may be evaluated by the organization, taking control of your own growth means that you also evaluate in return to see whether your expectations from the organization are still aligned.

Remember an investor does not have an emotional connection with the company they invest in - it is purely a value play. As long as the company has value, the interests are aligned, when the company starts losing value, the investor exits their investment. If they hold it for emotional reasons, then that is not an investment, it is just a sentimental instrument.

This is however a more difficult choice when it comes to moving from one organization to another. The investment of time over the years, the connections with colleagues and friends, and the network inside the organization that has been built over time are the intangible elements that we cannot put a price on per se. But this is also why it’s important to reflect on the circumstances and make calculated rational decisions.

One thing to note is that when the organization is forced to make a decision, would it consider all these different perspectives when it decides to trim or downsize? You would most likely be told that it is a company decision and not to be taken as personal or pointed at individuals.

Over the years, I have personally been through many changes and I have seen various shades and colors of how the organization makes decisions in good times and bad times. There are phases where things are good and phases where things are not so good.

(Photo by Iván Díaz on Unsplash)

The only thing that you as an individual are in control of is the efforts you take to work on yourself building your intrinsic value. As pointed out by Satya Nadella - we have to be humble enough to realize that nothing lasts forever and therefore we need to keep working on reinventing ourselves.

Hope you enjoyed this post. If you have any reflections on the points here, I would be very happy to hear back. Please share your comments.

As always, my goal with the posts is to provide some food for thought and to encourage my readers to reflect a bit.

So now, coming back to the title 😁. This was a song by an English Punk Rock Band called The Clash from the album Combat Rock.

Below are the lyrics to the final chorus. Just click below and it will take you to the song.

Enjoy the week ahead!

See you in the next one!!

Jithin